Nevada

EV Charging in Nevada -

Solar Power in Nevada -

Nevada’s official stance on electric vehicle (EV) charging infrastructure combines supportive policy frameworks and incentives with uneven practical outcomes backed by data. As of late 2025, Nevada has roughly **600–630 public EV charging locations statewide with over 2,500 charging ports, including both Level 2 and DC fast chargers, according to the U.S. Department of Energy’s Alternative Fuels Data Center. While this reflects ongoing investment in EV infrastructure, Nevada still struggles with a low charger-to-EV ratio compared with other states: with about 47,000 registered electric vehicles making up roughly 5 % of all vehicles, there are only about four charging stations per 100 EVs, placing the state around 43rd nationally for charger availability. This imbalance can lead to long wait times at busy stations in urban centers like Las Vegas.

At the policy level, Nevada has engaged with federal and utility-led initiatives to expand charging infrastructure. The state’s National Electric Vehicle Infrastructure (NEVI) plan secured approximately $38 million in federal funding to strategically build fast chargers along major corridors such as Interstate 80 and Interstate 15, aiming to provide reliable charging roughly every 50 miles. Additionally, the Public Utilities Commission of Nevada approved a $100 million Economic Recovery Transportation Electrification Plan led by NV Energy designed to deploy chargers across the state, including in historically underserved communities. Utilities also offer time-of-use electricity rates and incentives for businesses and multifamily properties to lower the cost of installing and operating EV chargers.

Despite these policy efforts and funding mechanisms, implementation has lagged, leaving gaps in the state’s charging network. Reports indicate that some planned utility-led buildouts have fallen short of initial goals, and in many rural areas infrastructure remains sparse with limited grid capacity and maintenance challenges. The NEVI program’s progress has also been complicated by federal administrative shifts affecting how and when funds are deployed, further slowing the rollout of stations along key routes. Collectively, Nevada’s approach reflects clear strategic intent and investment backing, but the actual network expansion has struggled to keep pace with the rapid growth in EV adoption, resulting in persistent infrastructure bottlenecks across the state.

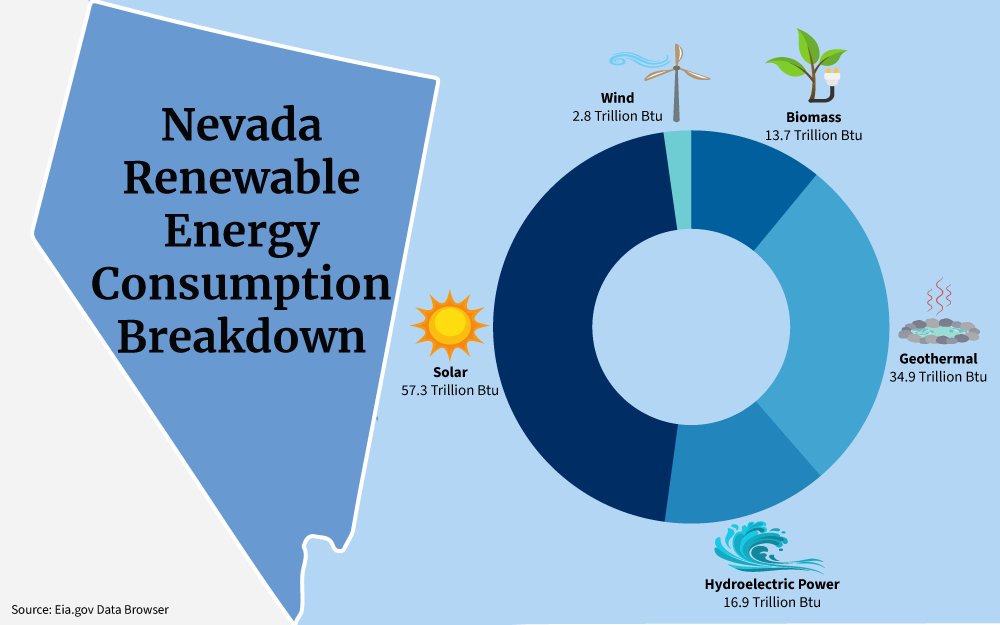

Nevada’s official state energy policy continues to support the expansion of renewable energy, including commercial‑scale solar, as a central part of its long‑term energy strategy. Under its Renewable Portfolio Standard (RPS), the state requires a growing share of electricity sold by utilities to come from renewable sources such as solar, with 34 % required through 2026 and scaling up to 50 % by 2030. This state‑level mandate creates a favorable regulatory backdrop for commercial solar projects by compelling utilities and developers to invest in and deploy large‑scale solar capacity across the state’s grid.

The policy framework also includes incentives such as the Renewable Energy Tax Abatement (RETA) program, which provides partial property and sales tax abatements to qualifying renewable energy facilities, including commercial solar installations, making them more financially attractive to developers and investors.

However, the economic environment for commercial solar in Nevada is being shaped strongly by changes in federal policy, which in turn influence state development prospects. Many of the federal incentives that previously underpinned the economics of commercial solar — such as the federal Investment Tax Credit — are scheduled to phase down or end around 2026, potentially increasing costs for new projects unless developers begin construction before key deadlines. Additionally, some federal grant programs that supported community and distributed solar have faced cuts or termination proposals, which could reduce available capital for related local initiatives. These federal shifts affect project financing and investor