Mississippi

EV Charging in Mississippi -

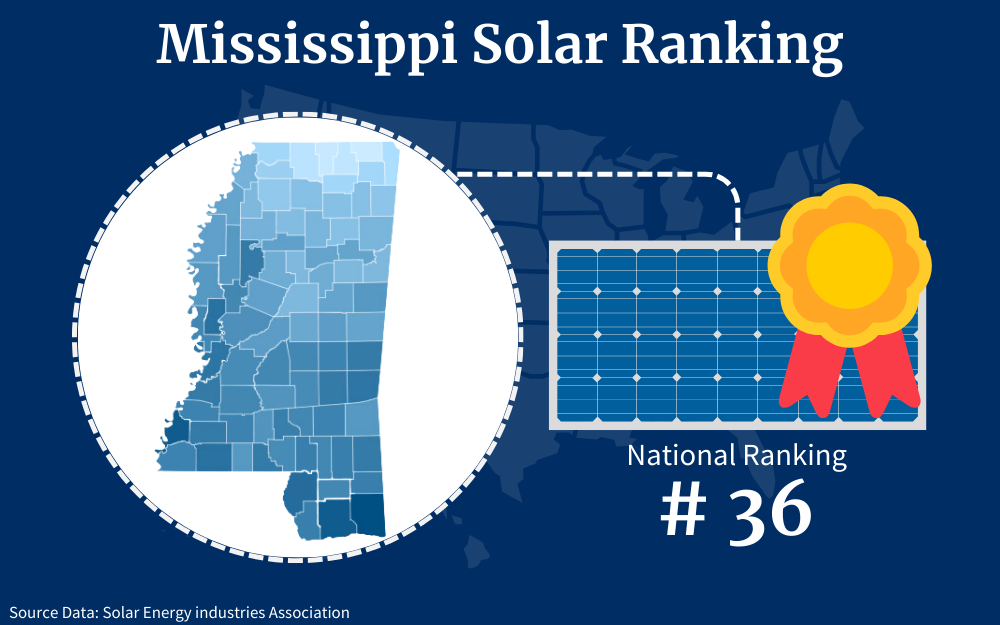

Solar Power in Mississippi -

Mississippi’s official stance on commercial electric vehicle (EV) charging stations in 2026 reflects a cautious but gradually evolving approach. Historically the state has had very low EV adoption and charging infrastructure, with one of the lowest numbers of public charging stations per capita in the nation. That limited build‑out has been driven more by private and local initiatives rather than aggressive statewide incentives or mandates — Mississippi ranked near the bottom in EV infrastructure and incentives compared with other states.

At the state policy level, Mississippi’s Transportation Commission is authorized to enter into public‑private partnerships and even provide grants to private companies for building charging stations under existing law (Mississippi Code § 65‑1‑181.1). Furthermore, federal funding under the NEVI (National Electric Vehicle Infrastructure) Formula Program has been allocated in Mississippi’s EV infrastructure plan — with more than $50 million earmarked through 2026 to deploy charging stations, especially along designated alternative fuel corridors — but much of that deployment was still in early phases as of early 2026. Local governments and utilities have also played a role: cities like Jackson and Clinton have installed charging stations with grant or corporate support, even if Mississippi as a state offers minimal direct tax incentives.

In the 2026 legislative session, policymakers continued wrestling with how best to regulate and encourage EV charging growth. For example, Senate Bill 2059 was introduced to govern EV charging station rates and to prohibit recovery of charging infrastructure costs from utility ratepayers, while ensuring nondiscriminatory terms for all providers — signaling an interest in creating a more competitive, market‑friendly environment for commercial chargers. Other legislative efforts like House Bill 1195 in 2025 sought to more clearly define operations and tariffs for charging stations, though not all passed. Overall, Mississippi’s stance in 2026 remains relatively limited compared with more aggressively pro‑EV states, but there is movement toward structured regulatory frameworks and use of federal funds to support commercial EV charging deployment.

Mississippi’s approach to commercial solar power in 2026 reflects a cautious but evolving stance that mixes ongoing project development with a regulatory environment that has historically been less aggressive than many other states. Large-scale solar and solar-plus-storage projects are actively being developed, often in partnership with utilities like the Tennessee Valley Authority (TVA). For example, developers such as Origis Energy have multiple solar projects in progress or newly operational—ranging from facilities like Golden Triangle II (150 MW plus 50 MW of storage) to the Optimist project expected to come online in early 2026, and even a 200 MW solar + 200 MW storage project slated for later in the decade—indicating robust commercial activity and utility-scale investment in the state’s renewable energy portfolio.

At the policy level, Mississippi does not have a formal renewable portfolio standard that mandates a specific share of renewables in the energy mix, and state-level incentives have been relatively limited compared with many other states. The Mississippi Public Service Commission (PSC) controls incentives and interconnection rules; net metering and distributed generation rules exist but historically reimbursed customers at rates lower than full retail value, and certain incentive programs like Solar for Schools and low-income support were suspended in 2024 before being reinstated in 2025 amid concerns about federal funding gaps. State tax incentives do provide significant property tax exemptions for large renewable energy investments (for projects with minimum capital investments), which helps attract commercial developers, though these are contingent on local approval and investment thresholds.

Commercial interest in solar remains strong due to projected economic benefits and private capital investment, with recent filings showing nearly $1.8 billion in proposed solar farm developments across the state—projects expected to generate construction jobs, long‑term tax revenues, and renewable energy capacity for decades. At the same time, legislative activity in 2026 includes efforts to address issues such as decommissioning and community impacts of solar facilities, suggesting the state is trying to balance renewable energy growth with landowner protections and infrastructure considerations.